What is ALGOGENE Marketplace?

ALGOGENE Marketplace is our brand-new 2-sided social trading service.

- [Subscriber]: For those who want to invest but lack of experience or time, it gives you the ability to invest in the strategies from experienced professionals!

- [Publisher]: For those who have already established a profitable trading strategy and want to scale up, it enables you to enjoy shared profits from publishing your strategies!

What's a social trading strategy?

When you use ALGOGENE platform, you will discover a wide range of trading strategies created by our global network of experienced researchers. All you need to do is to search for a strategy that is suitable for you, decide how much you want to invest, then wait and watch the trades executed for you.

What are the benefits to publish/subscribe on ALGOGENE Marketplace?

- You can tap into the experience of professional traders

- You have access to a wide variety of trading strategies

- You can free up time from closely monitoring the market

- You can have a free trail before subscription

- You can create secondary income and earn returns as a freelance strategy provider

Are there any drawbacks?

When using ALGOGENE Marketplace, it is important that you act responsibly to protect your account, which means weighing the pros and cons of strategies, rather than going on a 'feeling'. Here's how to trade responsibly on our platform:

- It could be convenient to simply follow professional's strategy, but it is still necessary to know what you are investing on

- High risk strategies can bring high returns when the market moves in your favor, but please be aware that there is an increased likelihood of volatility and potential losses too.

- Investing in strategies that focus on different assets, is a way to diversify your portfolio and reduce your risk exposures.

How do I get started as a strategy Subscriber?

Getting started is simple. Simply explore and search from ALGOGENE Marketplace for a strategy that matches your goals and risk appetite. You can refine the search results, apply filters and indicators, and even drill into the historical performance, to help you decide whether the strategy suits you.

How do I subscribe and invest on a strategy?

You can subscribe a strategy for either live-testing or real-trading. Subscription can be done as follows:

- Create an ALGOGENE strategy hosting account (Live-Test or Real-Trade)

- Open a real trading account from our supported brokers, and deposit funds to the account if it is for real-trading

- Bindle it with an ALGOGENE sub-account, and configurate the connection setting on ALGOGENE portal (refer to these posts 'Eqonex', 'Interactive Brokers', 'IG', 'OANDA')

- Search and choose a desired strategy from ALGOGENE Marketplace

- Click "Subscribe" button to start executing the strategy on your sub-account

After these steps, subsequent trades from strategy provider will be automatically copied to your trading account. Enjoy the automation and let's others work for you!

What is a subscription period?

A subscription period is a time period in which the system will execute the trades for you. It is effective immediately when you subscribe a strategy, and will be automatically recurred in a monthly basis.

How can I cancel a subscription?

If you have outstanding subscriptions, you can cancel as follows:

- After login the platform, go to [Settings] > [Algo Marketplace Config] > [Subscribed Algo Strategy]

- Select the corresponding account, then click "Unsubscribed algo"

After that, all your outstanding trades placed by the subscribed strategy will be closed immediately, and you will no longer be charged from upcoming billing cycles.

Can I stop runing the subscribed strategy during my subscription period?

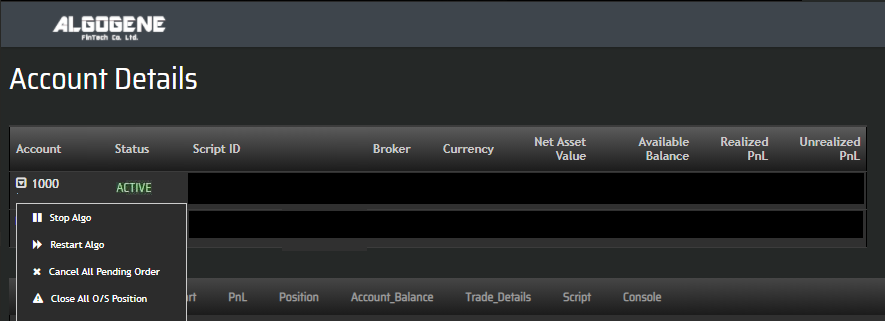

Sure, you can do it at any time if you consider the strategy doesn't perform well. Go to 'Live Test' or 'Real Trade' page depending on your case, then simply click "Stop Algo". Any open trades arose from that strategy will be immediately closed, and subsequent trades will stop executing on your account.

Can I restart the same strategy after stopping it?

Yes. Go to 'Live Test' or 'Real Trade' page depending on your subscription case, then simply click "Restart Algo".

Can I switch to another strategy during a subscription period?

Yes. You need to follow above to cancel the current subscription first. Then, go to ALGOGENE Marketplace to search for a new one.

Can I subscribe more than one strategy at the same time?

Yes. You can create multiple ALGOGENE sub-accounts to execute different strategies independently and simultaneously.

If I subscribe multiple strategies, are they considered to be separated investments?

Yes. As each strategy is executed on different ALGOGENE sub-account which eventually bindle to your different broker account. The new strategy has no impact on the strategy you have already subscribed to. This is because the amount you invest in each strategy will be fully segregated into different trading accounts. Therefore, the changes in one strategy's balance will not affect the balances of other strategies.

Can I close a specific order that was opened from a subscribed strategy?

Yes, you can, but you will be fully liable to:

- direct profit/loss from your action

- indirect profit/loss due to alter of trading behavior of the subscribed strategy incurred from your action

Besides, the profit/loss arose from such 'Manual Order' will be excluded from the calculation of profit sharing.

How does strategy subscription work?

When you subscribe a strategy, the size of the position opened on your account depends on your investment and the provider's strategy equity. Let's look at an example:

You invest US$2,000 in a Publisher A’s strategy. On the other hand, Publisher A has invested US$10,000 equity for that strategy.

Investor’s equity / Strategy equity = 2000/10000 = 0.2

It means that every position opened on the investor’s account will be 0.2x the size of the position opened on the strategy publisher's account.

Can my subscription trade at larger size?

Yes, we support various copy-trade mode. You can refer to this article for details.

How do I get started as a strategy Publisher?

For Publisher, you can either publish your backtest, live-testing, or real trading strategy. However, in order to ensure the integrity and quality of strategy on ALGOGENE Marketplace,

- We will confirm your personal identity by requesting relevant verification documents

- Your strategy need to pass serveral performance criteria, such as no. of trading days, annualized return, max. drawdown, etc

Your strategy will be listed and available on ALGOGENE Marketplace as soon as these criteria are fulfilled. For better credibility and confidence, it is also recommended that you have been real-traded or invested in your own strategy for some period before publishing them.

How much can I get when publishing my strategy?

When publishing your strategy, you have the feasibility to specify the desired reward amount or follow a default payout scheme.

- Fixed-price: you will receive a fixed amount of monthly subscription fee

- Default payout scheme: it is a dynamic pricing (capped at HK$1,380/ month) according to the latest score of your algo performance. For example, if your algo is scored 75 today, it will display a subscription fee of HK$1,380 * 75/100 = HK$1,035 on marketplace. If next week your algo perform better and get a score of 80, then the subscription fee will adjusted to HK1,380 * 80/100 = HK$1,104.

A higher "fee" you set might results in more income, but in the same time, investors might lose interests in subscribing your strategy. Thus, you are recommended to consider your target audience, potential investment size and returns, etc, in determining the "fee".

When will I get my entitled subscription fee?

We will immediately invoice and credit the fee to you, as long as payment has been charged from subscriber. It will normally take 3-5 business days to reach to your bank account.

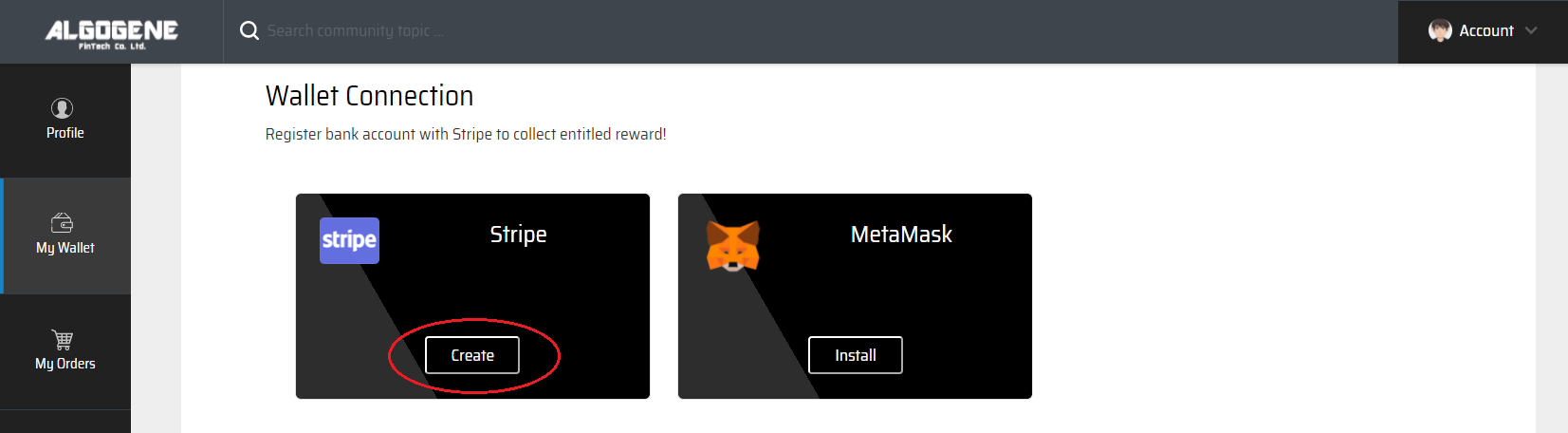

How do I get my entitled subscription fee?

To fulfill the compliance of Anti-Money Laundering (AML) and Know Your Customer (KYC), you are required to provide additional information to ALGOGENE to verify your personal identity. Stripe is our payment partner to perform the AML/KYC with you. All you need to do is to register as follows:

- Login the platform, go to [Settings] > [Add New Payment Methods], then click [Stripe]

- Fill in all the required information

- Stripe will verify your provided bank account, mobile and email

- After the KYC process, ALGOGENE is then authorized to transfer any entitled fee to your provided bank account in the future.

How to publish my strategy?

Please refer to the coming post for the details.