The world of foreign exchange (FX) has long been the backbone of global trade, ensuring that currencies flow seamlessly across borders. However, the traditional FX model, which relies heavily on outdated systems, often results in delays, risks, and inefficiencies. As we transition into a more digital age, stablecoins are emerging as a revolutionary solution, redefining how we think about currency exchange and settlement.

The Challenges of Traditional FX

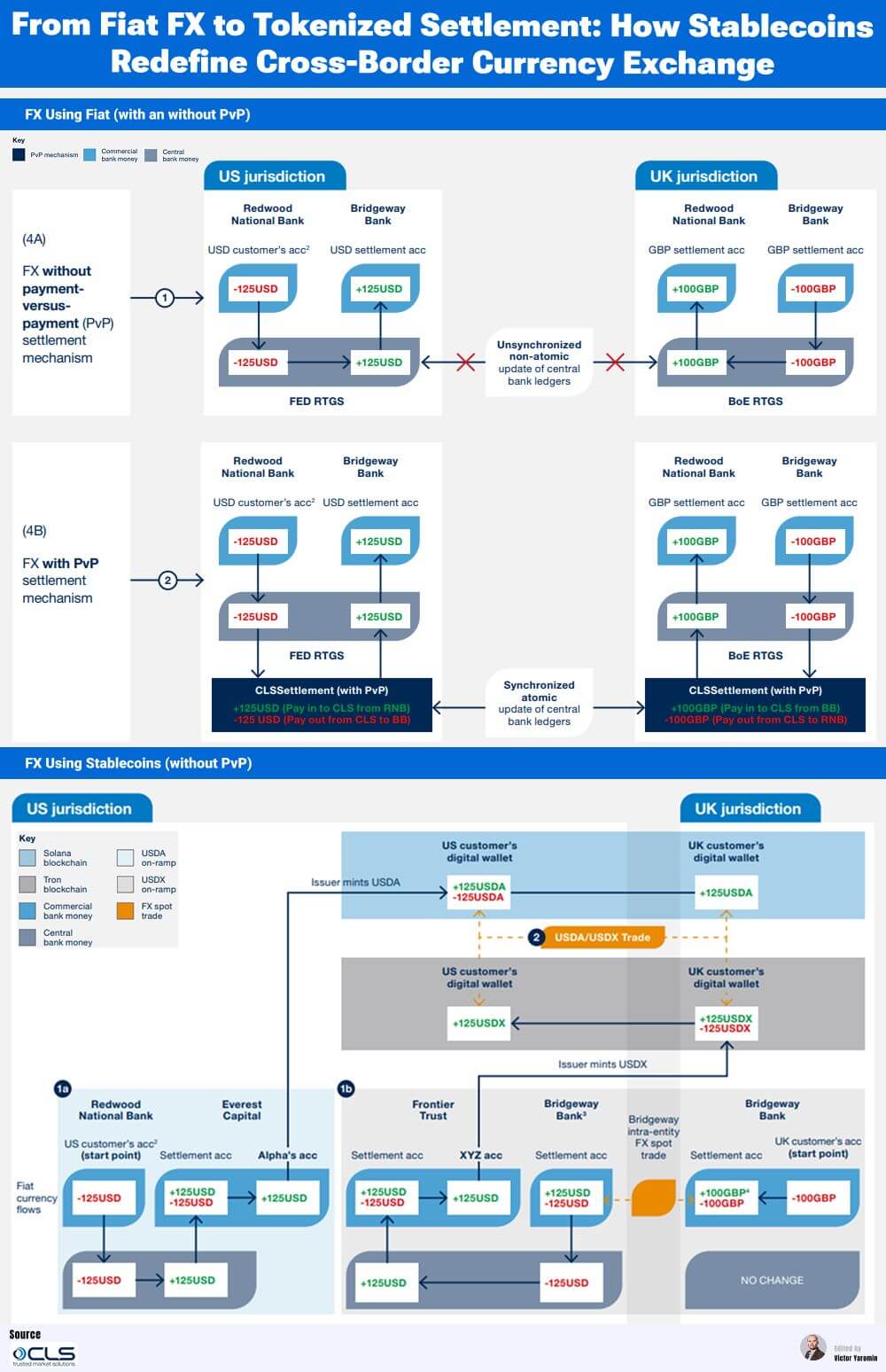

In the legacy model of FX, banks in different jurisdictions operate independently, updating their ledgers without synchronization. This lack of coordination creates exposure and risks, as one bank may settle a transaction while another lags behind. The traditional process is cumbersome, relying on central bank infrastructure that is slow and often prone to error.

Payment-versus-Payment (PvP) Settlement

To address these issues, systems like Payment-versus-Payment (PvP) were introduced. PvP synchronizes ledger updates across banks, significantly reducing the risks associated with unsynchronized transactions. While this is a significant improvement, it still relies on the central bank infrastructure, which can be a bottleneck in the process.

Enter Stablecoins

Stablecoins represent a paradigm shift in the world of FX. These digital tokens are pegged to fiat currencies, allowing for on-chain representation of traditional money. For instance, the US Dollar can be tokenized as #USDA, while the British Pound may become #USDX. This tokenization enables a more efficient and programmable flow of currency.

How Stablecoins Work

- Instant Transactions: Transactions executed with stablecoins occur nearly instantaneously on the blockchain. This eliminates the need for traditional intermediaries, which often slow down the process.

- Atomic Trades: With stablecoins, trades can execute atomically—meaning they either complete fully or not at all. This feature adds an additional layer of security and reliability to transactions.

- Enhanced Liquidity: Liquidity can move seamlessly between wallets, bypassing the need for synchronized Real-Time Gross Settlement (RTGS) systems. This instant liquidity is crucial for businesses engaged in international trade.

Why This Matters

The shift from traditional settlement models to stablecoin-based systems signifies a move from “settlement finality” to “instant atomicity.” This transition is critical for several reasons:

- Reduced Counterparty Risk: By minimizing the time it takes for transactions to settle, stablecoins significantly reduce counterparty risks. This is particularly important in volatile markets where delays can lead to substantial losses.

- Central Bank Evolution: As stablecoins gain traction, central banks may transition from being “end-settlers” to on-chain supervisors. This could lead to a more regulated and secure environment for digital currencies.

- Multi-Chain Interoperability: The potential for stablecoins to function across various blockchain networks could create a unified global value layer, streamlining cross-border transactions.

The Future of Stablecoins in Global Trade

Stablecoins are not just a passing trend; they are becoming a fundamental part of the financial ecosystem. As technology evolves, we can expect to see:

- Greater Adoption: More businesses and financial institutions will begin to adopt stablecoins for their cross-border transactions, recognizing the benefits of speed and efficiency.

- Regulatory Frameworks: As the market matures, regulatory bodies will likely implement frameworks to govern the use of stablecoins, ensuring consumer protection and financial stability.

- Integration with Traditional Systems: Over time, stablecoins may integrate with existing financial systems, allowing for a hybrid approach that combines the best of both worlds.

Conclusion

The evolution of stablecoins marks a significant milestone in the realm of cross-border currency exchange. By addressing the inefficiencies of traditional FX systems, stablecoins promise faster, safer, and more efficient transactions. As we move forward, it’s clear that stablecoins are not just a component of the cryptocurrency landscape—they are becoming the backbone of modern cross-border finance. Embracing this change could unlock new opportunities for businesses and consumers alike, paving the way for a more interconnected global economy.