In the past few years, different forms of "crypto-currencies" such as Bitcoin and Litecoin, have emerged in the financial market. These cryptos usually have the following properties:

- deploy the Distributed Ledger Technology (DLT),

- have a limited amount of issuance based on "mining" by participants,

- can be transferred and traded online between participants without a central clearing agent

It has been argued that "crypto-currencies" would disrupt the traditional fiat money, especially when some central banks issue enormous amount of fiat money via quantitative easing. Will "crypto-currencies" become an alternative form of money in the future?

While it is true that "crypto-currencies" such as Bitcoin have attracted many investors and speculators around the world who own and trade them, it is very different from such "crypto-currencies" being accepted as a form of "money". To answer this, let's look at the benchmarks discussed in a pervious post.

- Medium of exchange

- Store of value

- Unit of account

Medium of Exchange

So far, "crypto-currencies" are not readily accepted as a medium of exchange! Despite some popular U.S. companies (eg. Microsoft, AT&T) started accepting Bitcoin payment, there is still lack of evidence showing that "crypto-currencies" are widely used as a medium of exchange in the purchase of goods or services in a large scale.

In fact, Bitcoin is an inefficient means of payment for the following reasons:

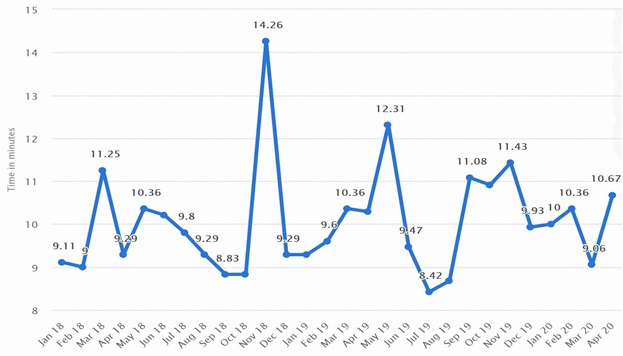

- As Bitcoin operates in a decentralised network, each transaction needs to be validated by solving a complicated math problem using specialised computers (i.e. so-called mining). It consumes considerable time and electricity to complete a transaction. The average transaction time is currently about 10-20 minutes, while it can take more than an hour during periods of high network traffic.

- Transaction fee is also high and volatile from time to time. The fee is to compense and incentivize miners for the time, effort, and resources that they put in to validate the unconfirmed transactions. CNBC reported in December 2017 that users were paying US$28 on an average to transact using Bitcoin. In contrast, electronic payments using commercial bank balances, typically take a few seconds and cost a fraction of the transaction fees in Bitcoin transfers.

Store of Value

Cryptocurrency has no intrinsic value, and there is no institution or institution to support its value or purchasing power. Their prices and values are determined only by the forces of supply and demand at the time, which fluctuate sharply depending on the appetite of the participants.

Indeed, in some countries, the value or purchasing power of their currency also has great volatility. However, it should be noticed that such fluctuations usually occur in times of crisis or in jurisdictions with bad macroeconomic, fiscal or monetary discipline. But for Bitcoin and most other cryptocurrencies, their volatility seems to be structural, and the market dynamics that determine their price or value are quite opaque and difficult to discern.

Due to the high volatility in value, the acceptance of cryptocurrency as a store of value or a means of exchanging goods and services brings huge risks to all parties.

Unit of Account

With very high volatility and limited use as a means of payment, it is unlikely that societies would adopt "crypto-currencies" as a unit of account in the near future.

Conclusion

Based on the analysis above, "crypto-currencies" are not qualified to be money or currencies!

Moreover, unlike other forms of electronic money using bank balances, "crypto-currencies" are not scalable! The technical design of "crypto-currencies", for example Bitcoin, is such that the transaction time and costs would go up if more people use or transfer them. This would actually undermines its prospect of gaining moneyness over time.

If such technical bottleneck is not resolved, it is unlikely for "crypto-currencies" to be adopted for large scale use. Therefore, we call them crypto-assets instead of “crypto-currencies” for the rest of this article.

Challenges to Regulators

Here highlights some of the challenges/blockers for supervisors and policy makers to accept crypto-assets.

- Financial Stability: According to Financial Stability Board (FSB), the current crypto-assets do not pose a material risk to global financial stability given the relatively small size of the market. However, closely monitor is necessary in view of the speed of developments and data gaps.

- Illegal Activities: Many crypto-assets are designed in way that anonymous email accounts can be used for trading and transfers without a central clearing agent, they effectively bypass the existing regime in combatting money laundering, terrorist financing and other illicit activities. The ease with which crypto-assets can be transferred across national borders has made it even more attractive to criminals in laundering their proceeds and income. It is difficult for banks and other regulated financial institutions to comply with the supervisory requirements in respect of know-your-customer (KYC) or ascertaining the source of funds.

- Market Integrity: As most of crypto-assets are traded in unregulated online platforms, there are significant gaps in data collection and investor protection. The security or integrity of some of the trading platforms is also in doubt given the number of cyber incidents that have led to significant losses of the investors.

Final Thoughts

Notwithstanding what mentioned above, we should not rule out one day new technology emerges in such a way that would address the regulatory concerns that are present in the current generation of crypto-assets. However, in adopting new technology and innovation, we must also guard against the risk of overlooking the nature of the financial transactions and the risks that are inherent.

We just need to keep an open mind and stand ready to learn and adapt to new technology and trends.