What is Grid Trading?

Grid trading is a rule-based strategy commonly used in crypto and forex market. It involves setting multiple predetermined price levels above and below a reference price, creating a grid of orders at incrementally increasing and decreasing prices. The price levels resemble gridlines on a grid; hence, the name grid trading.

The buy or sell orders are automatically executed when the price touches such levels. The technique seeks to capitalize on normal price volatility by placing buy and sell orders at certain regular intervals above and below a predefined base price.

There are various form of Grid Trading that makes this strategy applicable for different types of market environments, including trending and sideway market.

How Grid Trading works?

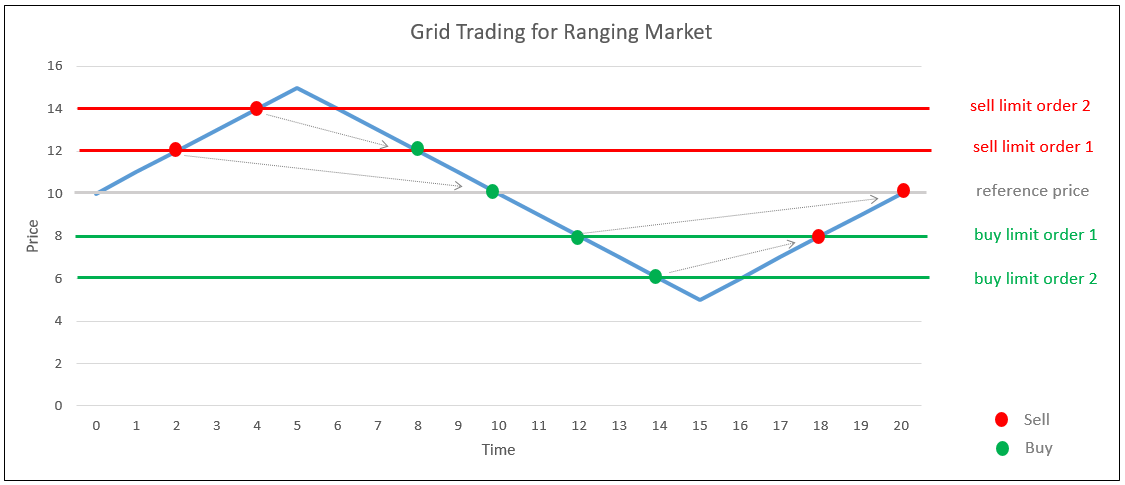

Ranging Market

In ranging market, a trader could place buy limit orders every X points below a reference price, and sell limit orders above. In this example, we set reference price to $10 and a grid size of $2. When market fluctuates within a range, all the limit orders are filled and we can effectively earn 8 price points.

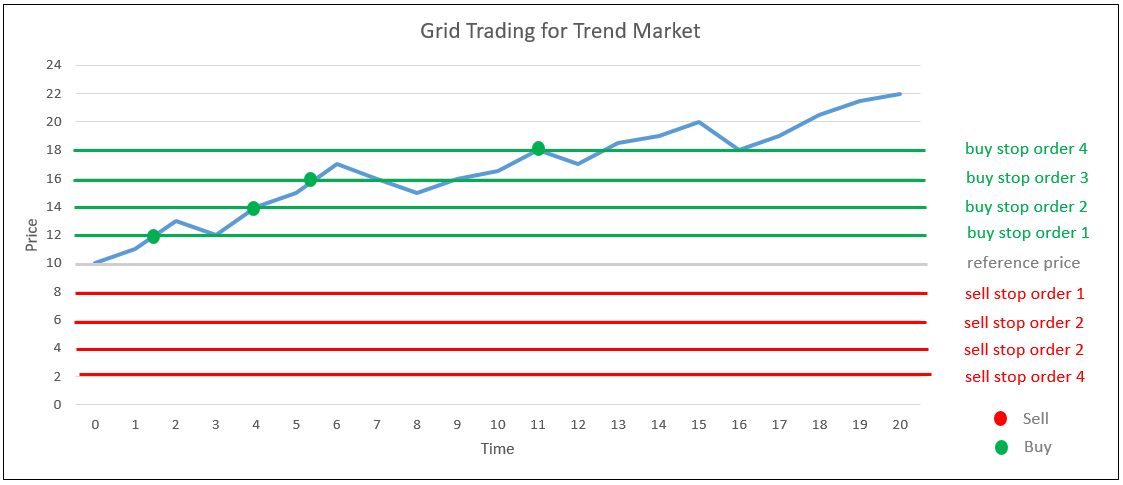

Trend Market

In trend market, a trader could place buy stop orders every X points above a reference price, while also putting sell stop orders every X points below that price. In this example, we set reference price to $10 and a grid size of $2. When price continues to rise, the stop buy orders will get filled. In this example, our unrealized profits would be (22-12) + (22-14) + (22-16) + (22-18) = 28 price point.

What are the advantages?

- Relatively Simple: Unlike other trading model which requires various inputs such as economic and fundamental factors, financial projections, etc, grid trading only requires price as input. Users only need to define the number of price levels in the grid, as well as the grid size.

- Systematic: Grid Trading strategy is systematic meaning that it doesn't require human judgement and prediction on market direction. Once the grid price levels are set, the strategy can run automatically.

- Market Dynamics: Grid Trading is suitable for different market environments, such as trending or ranging market.

Does Grid trading guarantee making profits?

No. All trading strategy has its pros and cons. There won't be a trading strategy that can acheive 100% win rate in long run.

How to enhance a Grid Trading strategy?

Traders can optimise a grid trading strategy by adding risk-management tactics.

- Stop Loss: early cut-loss when the market goes against your trades. For example, suppose our grid is initially setup to trade for a ranging market, if market continues to drop without hitting the sell-order level, we will accumulate a large buy position with a large floating loss.

- Position Size: reduce the position size is to make sure each individual trade is only a small percentage of the overall portfolio

- Moving reference price: if market moves away from the orginal grid range, there will be a portion of opposite orders that are left which have less probability to get filled. Thus, it would better to reset the reference price and to create another set of grid orders.

Conclusion

Grid trading is a rule-based strategy that doesn't predict the market direction. In order to create an effective grid trading strategy, it is important to understand how your chosen market is typically trending or ranging. Also, you need to manage when to take profit and stop loss.