What is an Investment Portfolio?

In financial market, a portfolio generally refers to a collection of financial investments, such as bonds, stocks, commodities, etc. In fact, a portfolio can also include any tradable assets like real estate, art and private investments.

Why we need a portfolio?

The key concept in portfolio management is about diversification. It simply means not to put all your eggs in one basket.

Diversification tries to reduce risks by allocating investments across different

- financial instrument

- industry

- asset class

- region

- trading strategy

By investing in different areas, the underlying is expected to react differently to the same event and therefore the overall risk could be reduced.

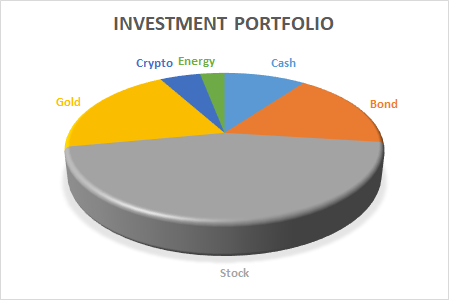

What is portfolio allocation?

You may think of portfolio allocation as a pie divided into pieces of varying sizes. Each piece represents a different type of investment.

Investors aim to construct a well-diversified portfolio to achieve a risk-return balanced allocation that is appropriate for their risk tolerance level.

What to consider for constructing my portfolio?

There are many ways for portfolio allocation or diversification. Your target return, risk appetite, and financial constriants are all factors in deciding how to build your portfolio.

What ALGOGENE can help?

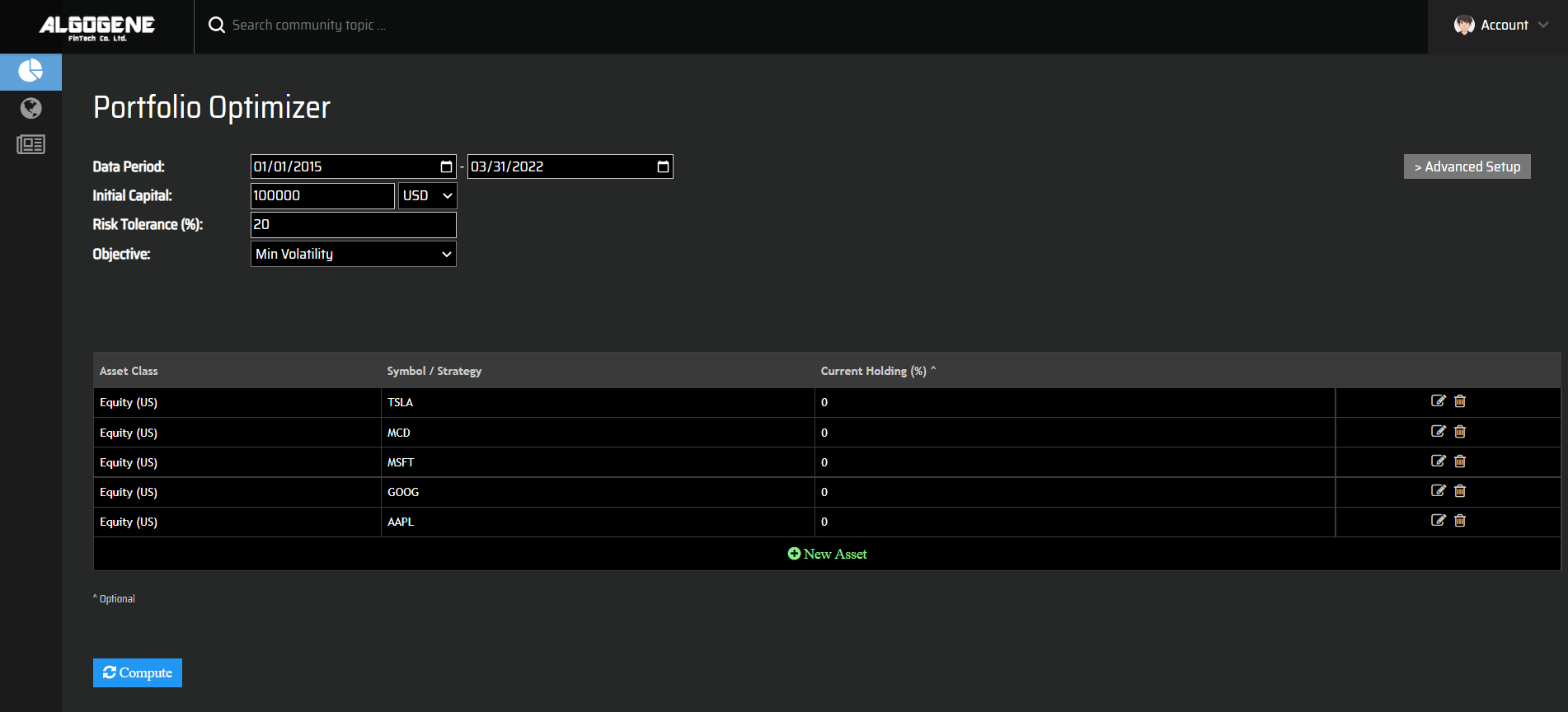

Our award winning Portfolio Builder allows you to construct, analyze and optimize your investment portfolio!

It supports various optimization methods under dynamic constraints, including:

- Minimize Total Risk

- Maximize Sharpe

- Maximize Sortino

- Minimize Tail Risk

- Risk Parity Diversification

Where can I get start?

- login ALGOGENE portal

- go to [Market Analysis] > [Portfolio Optimizer]

- specify the

- analysis horizon

- investment asset or algo strategy

- financial constrainsts

- optimization method

- Compute result and that's it!

How much it cost?

Registered users are eligible for the free tier. If you are looking for more advanced analytics, please refer to https://algogene.com/services#divServicesPortfolio

Conclusion

- Portfolio is an effective way to diversify investment risk!

- A portfolio is usually for long term investment, but please keep in mind that analysis based on historical results doesn't gurantee for future performance. Structural market changes might require portfolio rebalancing.

- ALGOGENE has already simplified the complexity for portfolio analysis. What left for you is to decide your own investment scope, risk level, financial constriants and perference.

Demo Video

Happy Trading! :)