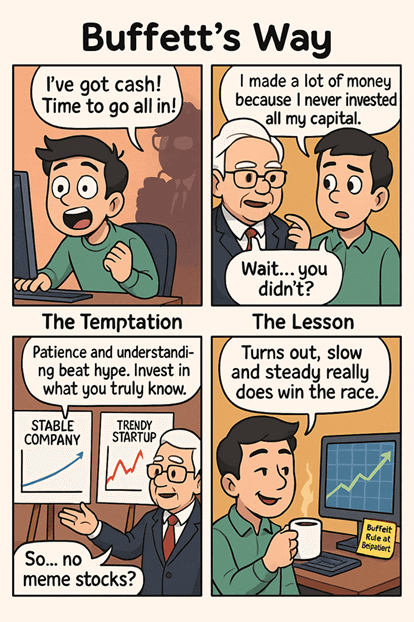

"I made a lot of money because I never invested all my capital." — Warren Buffett

In the world of investing, Warren Buffett is renowned for his exceptional insight and prudent strategies. His investment style relies not on short-term market fluctuations but emphasizes patience and a deep understanding of companies. Buffett often states that good opportunities do not arise every day; the key is to remain patient and wait for investments that promise high returns.

Patience: The Key to Success

Buffett's success stems partly from his focus on cash flow. He does not rush to invest merely because he has a high cash balance; instead, he prefers to wait for years until truly attractive investment opportunities appear. This patient approach serves as a reminder that rushing can lead to unnecessary losses.

Stability Over Prediction

For Buffett, the focus of investment is on a company's current profitability rather than future market predictions. He assesses long-term investment returns based on a company’s potential earnings. This means he prefers to invest in stable and transparent companies rather than chasing trends in 'novel' firms.

If a company is unstable, Buffett cannot accurately assess its real value, increasing his investment risk. Therefore, a key element of his investment strategy is to "invest only in stable and easily understandable companies."

Fundamental Investment Principles

Buffett's success is not only due to his personal wisdom but also influenced by his mentor, Benjamin Graham. Graham taught him to minimize investment risk, a principle that has profoundly shaped Buffett’s investment philosophy. Sound financial management and long-term patience are beliefs that Buffett consistently upholds.

In today’s market environment, investors should learn from Buffett’s principles, maintaining calm and carefully choosing their investments. Opt for companies with stable earnings and clear business models, and be patient, waiting for the right moment to invest.

Conclusion

Warren Buffett's investment philosophy reminds us that successful investing is not about chasing short-term profits but achieving long-term stable growth. By selecting stable companies, exercising patience, and investing at the right time, we can also carve out our path to success in this ever-changing market. Let’s embrace Buffett’s wisdom and seize every investment opportunity!