What is an algo portfolio?

An algo portfolio is a type of investment portfolio that incorporates multiple independent trading algorithms to manage and execute trades in various markets and assets, such as stocks, commodities, and forex.

Each algorithm in the portfolio is assigned a different weighting depending on its performance and the overall investment strategy. The concept is similar to a traditional investment portfolio or a fund of funds (FOF), but it uses sophisticated algorithms for trading decisions. For quantitative traders, an algo portfolio is often preferred as it allows for better risk diversification.

How to construct an algo portfolio?

Suppose you have several trading algorithms ready. You may already deployed some of them for live-testing or real-trading, or it may just be a simple backtest result. No worries, the system is capable to analyze for all these situations. Follow a similar procedure in this post "Invest like a professional with Portfolio Builder".

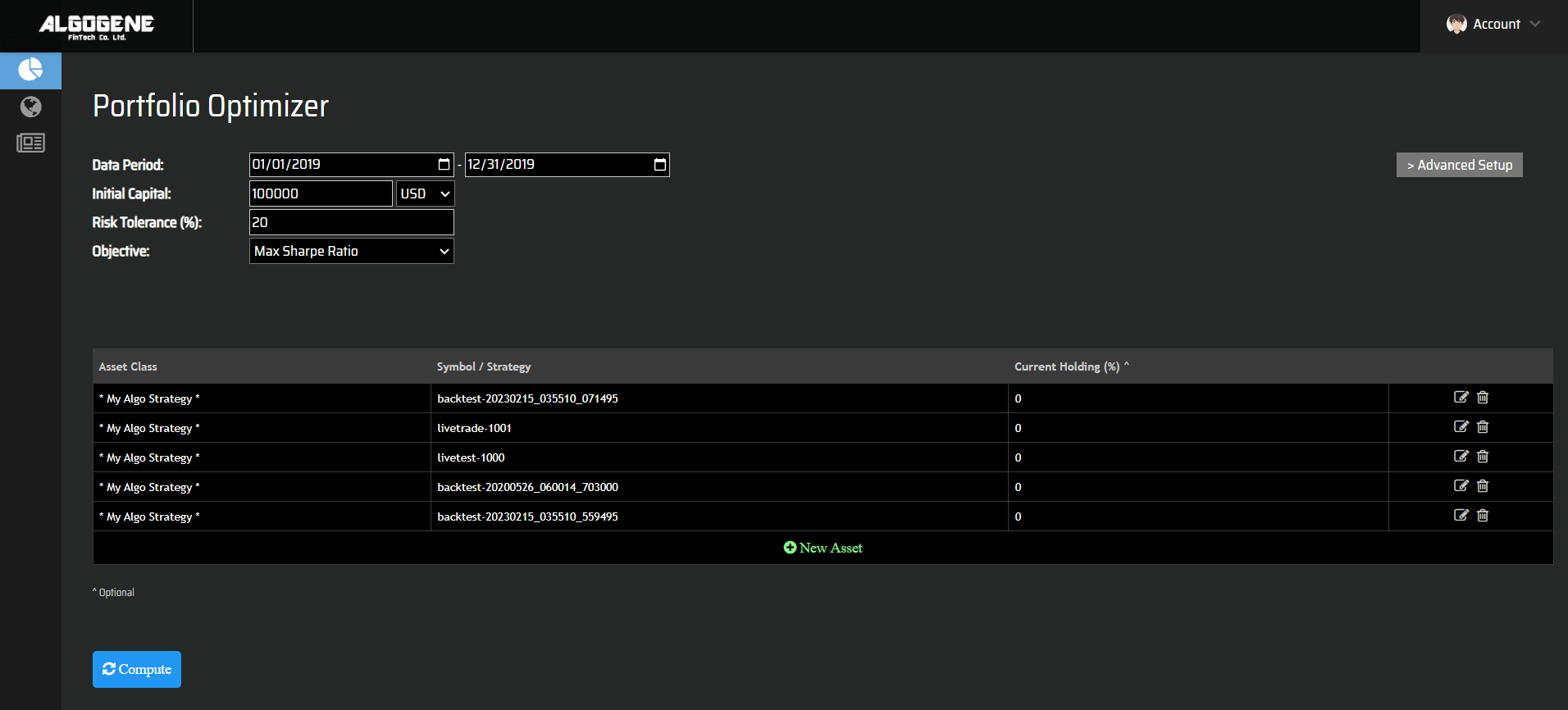

- Login the platform, go to [Market Analysis]

- Set the analysis period, optimization goal, etc

- "Asset Class" chooses "My Algo Strategy"

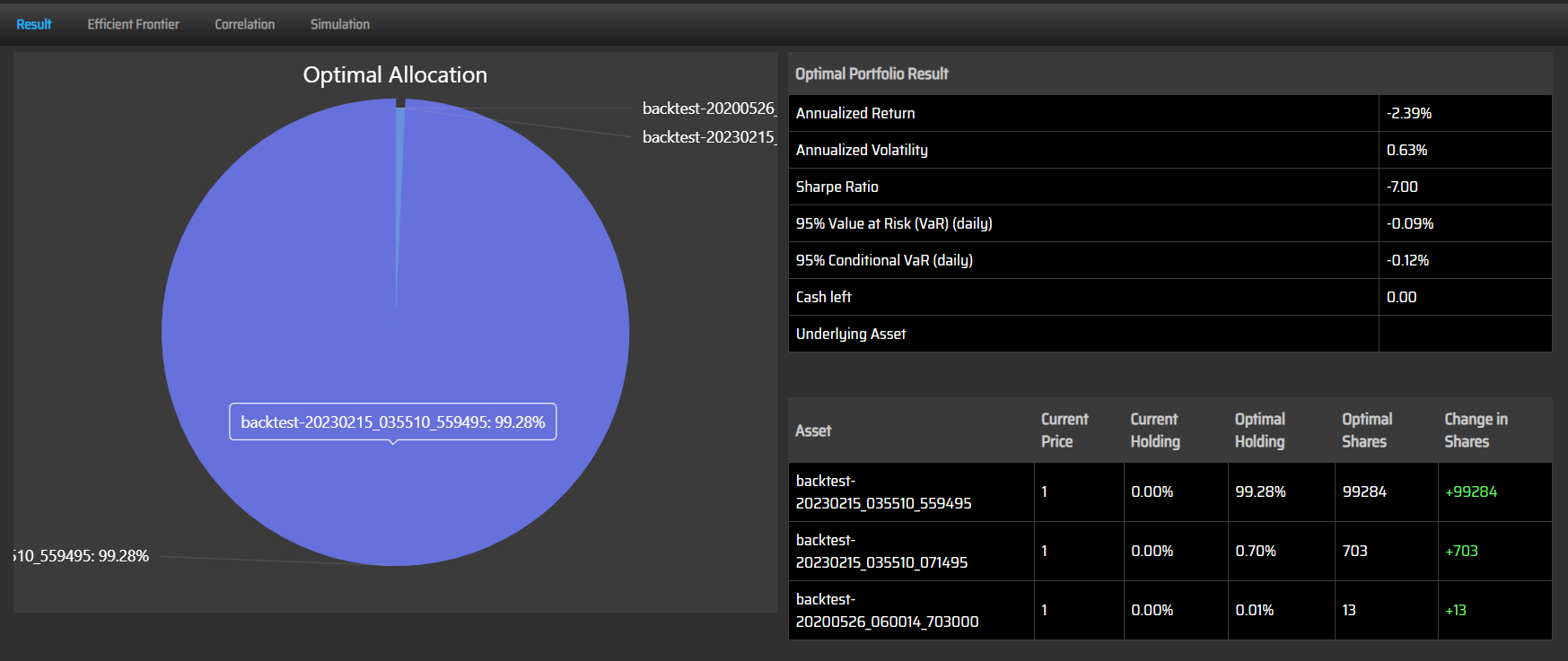

- Click "Compute" to generate the optimal portfolio

How to deploy an algo portfolio to live?

Suppose your algo portfolio consists of N individual strategies.

- Make sure you have created N+1 subaccounts. It can either be live-testing or real-trading, or a mix of them. Click here to create subaccounts if needed

- Follow the steps in this article [Deploying your first Robo-Trader] to run each of the individual strategies to the first N subaccounts

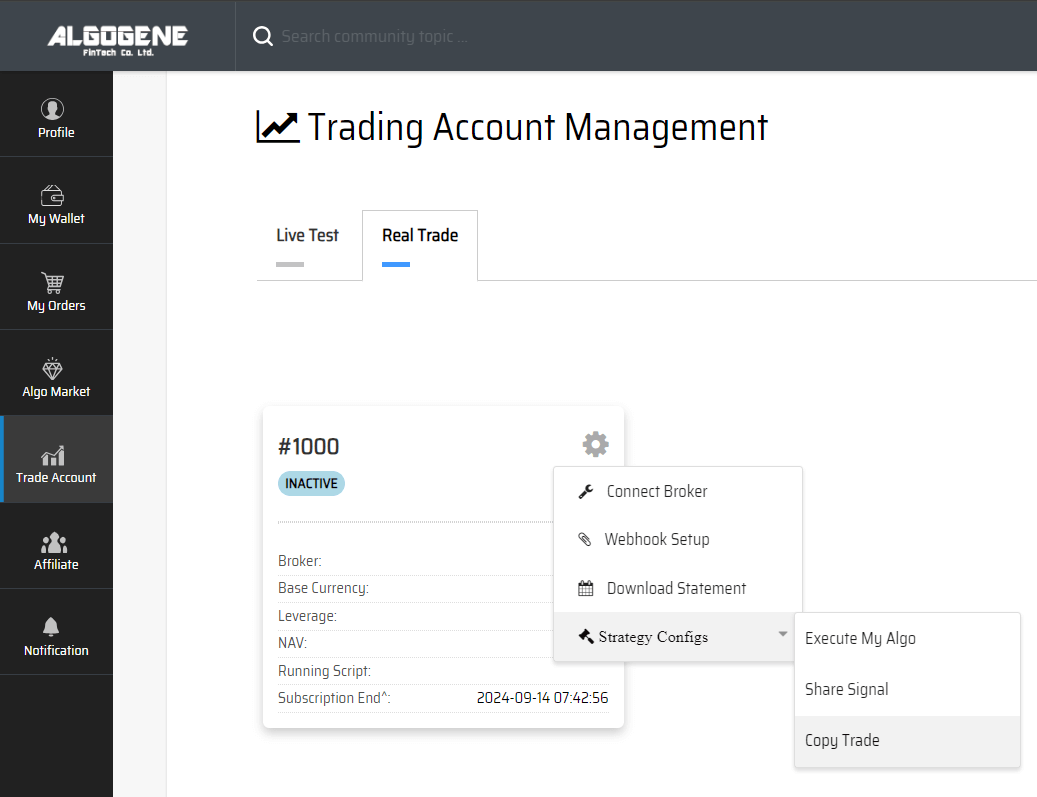

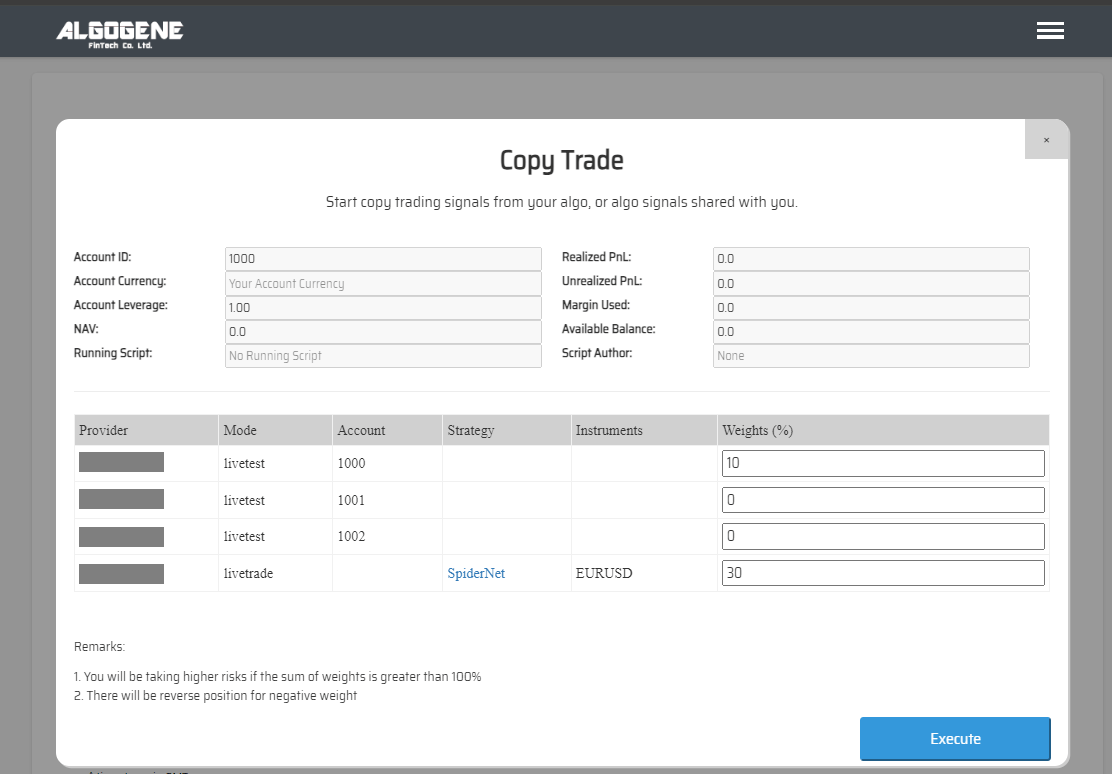

- For the N+1 subaccount, go to [Settings] > [Trade Account] > [Strategy Config] > [Copy Trade]

- Set your desired allocation, then click "Execute"