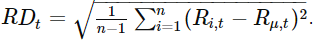

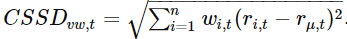

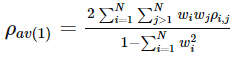

Given n stock time series X1, X2, ... Xn, I want to measure how much they have dispersed over time. For example, are they moving "more together" this year comparing to last year?

If there are only 2 time series, then I can just calculate the correlation of X1 and X2.

For a large number of n, I would like to know if there are proper statistical measurements for this.