It is related to the representation of timestamp for candles.

For many stock charts (eg. Yahoo Finance, TradingView, etc), timestamp usually refers to the opening time of a bar.

For example, this bar summarizes the price information from 1-Dec-2020 00:00:00 to 1-Dec-2020 23:59:59.

- time: 1-Dec-2020

- open price: 19699.92

- high price: 19892.44

- low price: 18119.00

- close price: 18791.58

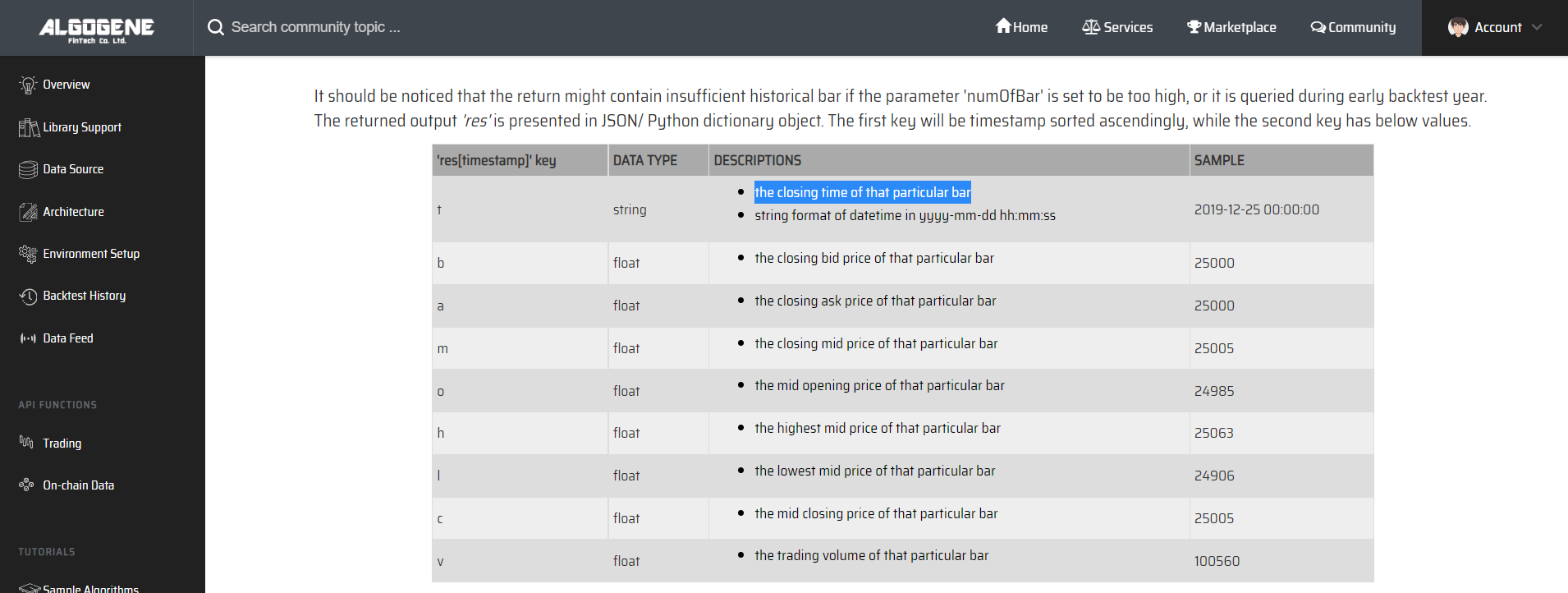

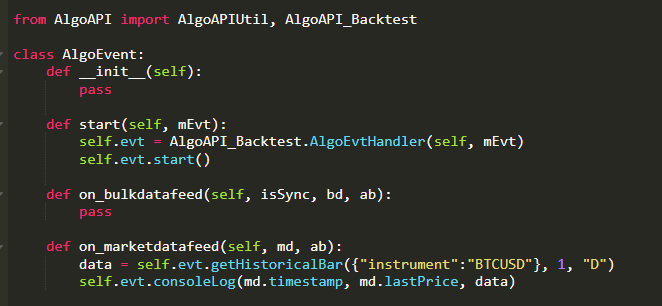

However, as mentioned in Tech Doc, ALGOGENE implemented "getHistoricalBar" using the closing time of a bar to prevent front-running problem.

Therefore, when we conduct backtest/ live-trading on the platform,

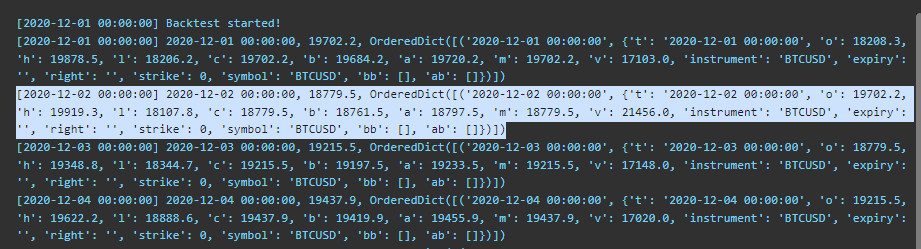

We can observe the full day info for 1-Dec only when the backtest time proceed to 2-Dec. Also, we should refer to the data with timestamp 2-Dec-2020 to compare with the chart above.

- time: 2-Dec-2020

- open price: 19702.2

- high price: 19919.3

- low price: 18107.8

- close price: 18779.5

Original Posted by - admin:It is related to the representation of timestamp for candles.

For many stock charts (eg. Yahoo Finance, TradingView, etc), timestamp usually refers to the opening time of a bar.

For example, this bar summarizes the price information from 1-Dec-2020 00:00:00 to 1-Dec-2020 23:59:59.

- time: 1-Dec-2020

- open price: 19699.92

- high price: 19892.44

- low price: 18119.00

- close price: 18791.58

However, as mentioned in Tech Doc, ALGOGENE implemented "getHistoricalBar" using the closing time of a bar to prevent front-running problem.

Therefore, when we conduct backtest/ live-trading on the platform,

We can observe the full day info for 1-Dec only when the backtest time proceed to 2-Dec. Also, we should refer to the data with timestamp 2-Dec-2020 to compare with the chart above.

- time: 2-Dec-2020

- open price: 19702.2

- high price: 19919.3

- low price: 18107.8

- close price: 18779.5

Original Posted by - Hyunjun Yoo: Thank you for replying. I understand why there is a time term with backtest data and market data.But I still confused with omitted data in backtest data. In case of my script in my picture, there is no closing price in 2020-12-05. Could you explain about this problem? Due to this problem, I always got quite big different RSI value.