What is paper trading?

Paper Trading (also called Live Testing, Demo Trading, or Mock Trading) is a real-time simulation of trade which allows an investor to practice buying and selling without risking real money. The term "paper trade" dates back to a time when online trading platforms were not widely common. At that time, a paper trader recorded all trades by hand to keep track of hypothetical trading positions, and profits or losses.

The development of online trading platforms and software has increased the ease and popularity of paper trading. Nowadays, many brokers (eg. Interactive Brokers, IG, OANDA, etc) offer clients paper trade accounts which allow investors to trade live markets without the commitment of actual capital. Nearly everything about the demo account is the same as their real trading account, except the investor is not trading real money.

Why paper trading is important?

No matter you are already an experienced algo trader or totally new to the financial market, the paper trading process can help you to:

- get familiar how to navigate a trading platform and make trades

- evaluate investment ideas/ strategies/ algorithms using a live and unseen dataset

How to paper trade with ALGOGENE?

All registered users are entitled to a live-test account on ALOGGENE. With the live-test account, you can either bind to an external broker's demo account or use ALGOGENE simulator for live paper trading.

- Login ALGOGENE portal

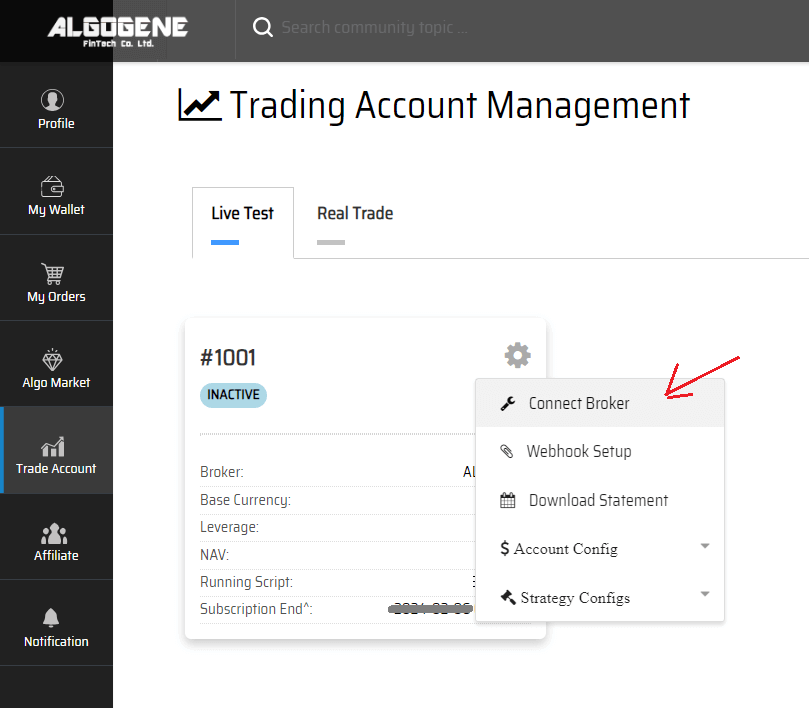

- Go to [Settings] page, then [Trade Account]

- Go to section [Live Test], click account config

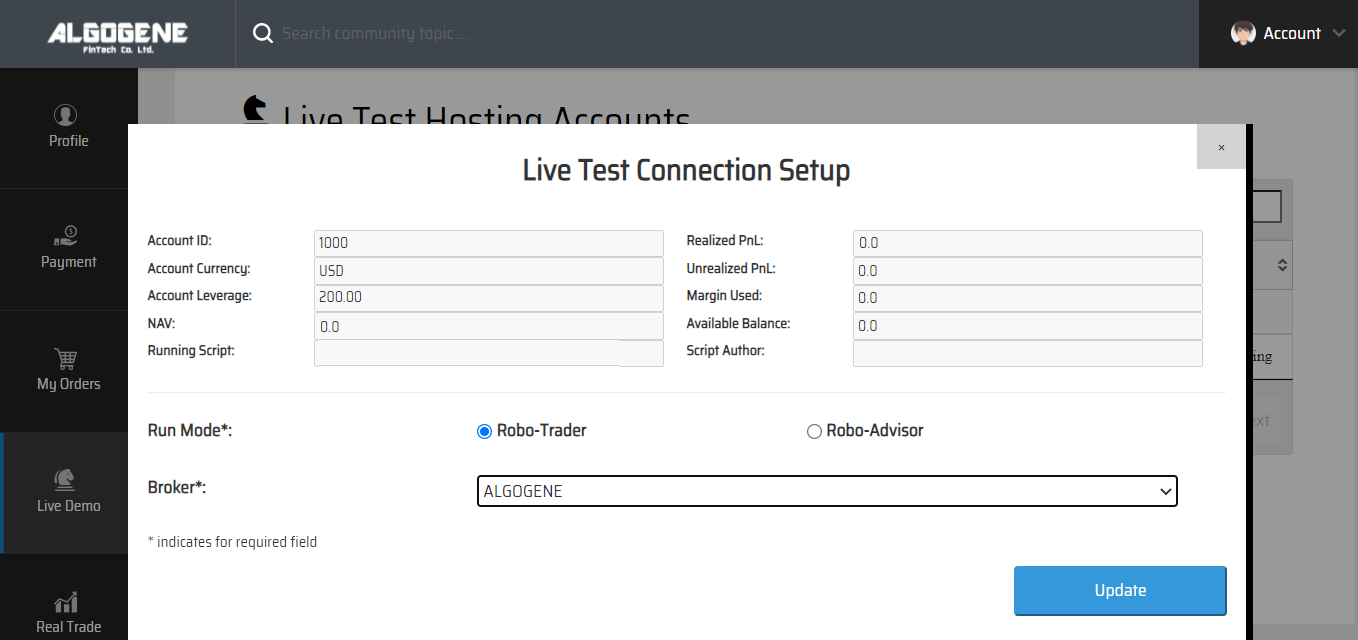

- In the broker list, select ALGOGENE

- You can also adjust the amount of virtual money in the paper account through the deposit/withdrawal button

Once the account has been setup, you are now ready for paper trade. ALGOGENE provides the feasibility for users to paper trade either in manually, semi- or fully-automatically.

- fully automatic algo execution

- manual trade input

- hybrid trade execution

1. Deploy Trading Algorithm

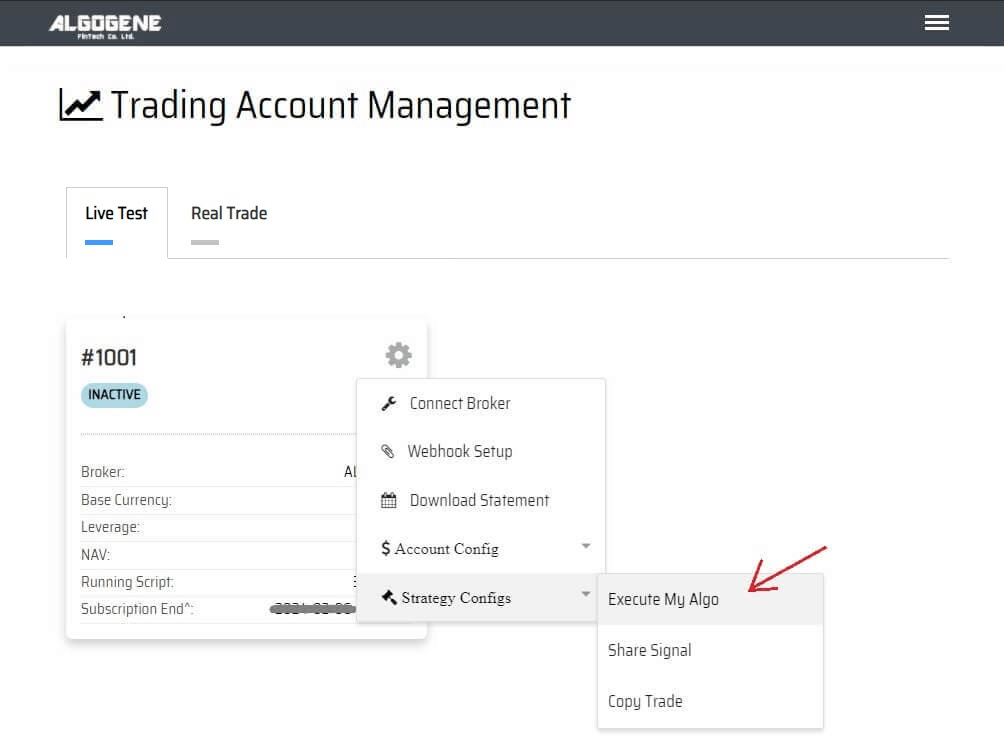

- Under [Settings] page, go to [Trade Account] > [Live Test] section, click "Execute Algo"

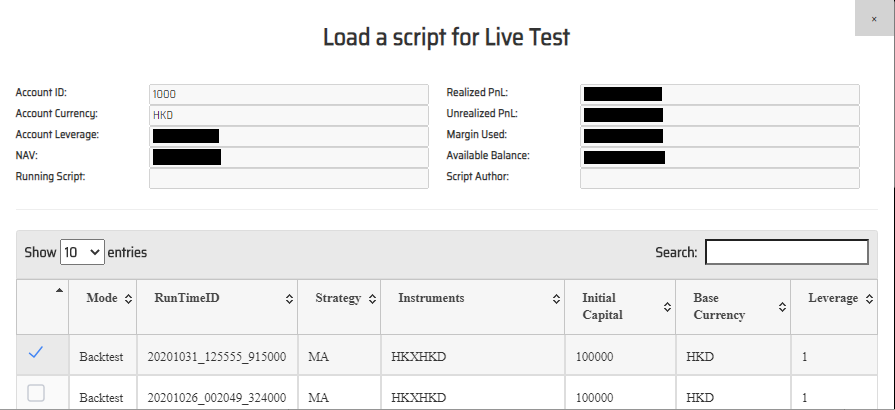

- choose any one of your backtested script and deploy to paper trading

- Go to [Live Test] page. Your trading robot is active now!

- You also have the feasibility to edit your script from livetest/real-trade interface. Here are the steps:

- Go to [Live Test] or [Real Trade] depending on your case

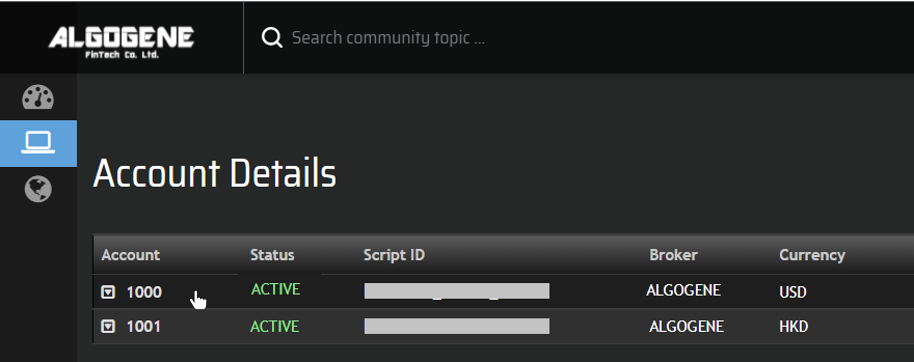

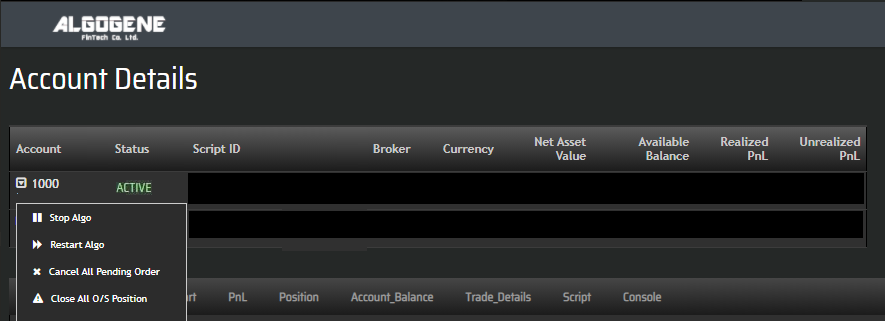

- Go to [Account Details], select your trading account and click "Stop Algo"

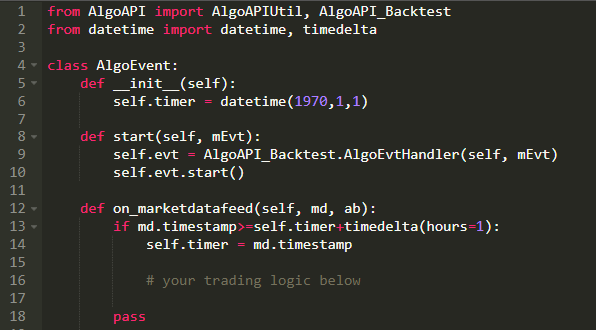

- Now, go to [Account Details] > [Script], re-write or update your trading logics, then press button "Run" (you can refer to Tech Doc for ALGOGENE Web APIs)

2. Manual Trading

- Go to [Live Test] page, then go to [ACCOUNT DETAILS] section

- Click a live-test account, say #1000

- On the right panel, search your desired trading instrument, and click "Trade"

- Input your trade detail, and click "SUBMIT"