Introduction

The cryptocurrency market is known for its volatility and rapid price fluctuations. As traders and investors seek to navigate this unpredictable landscape, on-chain data has emerged as a crucial analytical tool. By examining data recorded on the blockchain, analysts can gain insights into market trends, investor behavior, and potential future movements. This article delves into the importance of on-chain data, methods for analysis, and how it can be utilized to identify crypto trends.

Understanding On-Chain Data

On-chain data refers to all the information that is permanently recorded on a blockchain. This includes transaction history, wallet balances, smart contract interactions, and more. Unlike off-chain data, which may include external market indicators or social sentiment, on-chain data provides a direct view of the activities occurring within the blockchain ecosystem.

Key Metrics in On-Chain Analysis

- Transaction Volume: This metric indicates the total number of transactions within a specific timeframe. A rising transaction volume often suggests increased network activity and interest in a particular cryptocurrency.

- Active Addresses: The number of unique addresses that have sent or received funds in a given period. A growing number of active addresses can signal increasing user adoption.

- Hash Rate: Particularly relevant for proof-of-work cryptocurrencies, the hash rate measures the computational power being used to mine blocks. A higher hash rate indicates greater network security and miner confidence.

- Supply Metrics: This includes the circulating supply, total supply, and the percentage of coins held by whales (large holders). Analyzing these aspects helps in understanding the distribution and scarcity of a cryptocurrency.

- Network Fees: The fees associated with transactions can provide insight into demand and network congestion. High fees may indicate a surge in activity or speculative interest.

Formulaic Insights

To analyze trends using on-chain data, we can formulate some key equations:

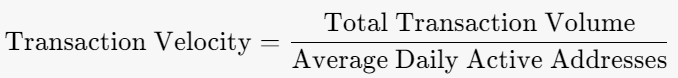

1. Transaction Velocity

Transaction velocity can be calculated to understand how quickly assets are moving through the network.

A higher velocity indicates a more dynamic market, while a lower velocity may suggest stagnation.

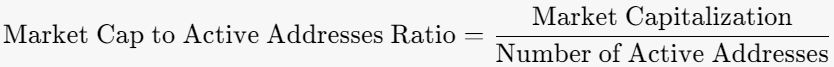

2. Market Cap to Active Addresses Ratio

This metric helps assess whether a cryptocurrency is overvalued or undervalued relative to its user base.

A declining ratio could indicate that the asset is becoming undervalued as more users adopt it.

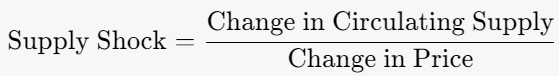

3. Supply Shock Indicator

This indicator assesses the potential impact of supply changes on price.

A significant supply shock may lead to price volatility, especially if demand remains constant.

Analyzing Market Trends

Identifying Bull and Bear Markets

On-chain analysis can help differentiate between bullish and bearish trends. For instance, in a bull market, we often see:

- Increased transaction volume: More trades suggest rising interest.

- Growing active addresses: More users entering the market.

- Increasing hash rates: Miner confidence is high, leading to more investment in mining infrastructure.

Conversely, in a bear market, on-chain metrics may show:

- Decreasing transaction volume: Less trading activity indicates waning interest.

- Falling active addresses: Users may be exiting the market.

- Declining hash rates: Miners may leave the network due to reduced profitability.

Sentiment Analysis Through On-Chain Data

On-chain data can also be correlated with market sentiment analysis. For example, a spike in transaction fees might indicate speculative trading, as traders rush to capitalize on perceived opportunities.

Example Case Study: Bitcoin

Consider Bitcoin (BTC) as a case study. By analyzing on-chain metrics, we can observe patterns that correlate with historical price movements:

- Transaction Volume: In the lead-up to the 2021 bull run, BTC saw a significant increase in transaction volume, indicating heightened market interest.

- Active Addresses: The number of active addresses reached all-time highs, suggesting a growing user base.

- Hash Rate: Despite market fluctuations, the hash rate remained robust, indicating confidence among miners.

- Supply Metrics: The percentage of BTC held by whales decreased as more coins were distributed to smaller holders, a positive sign for decentralization and adoption.

Conclusion

On-chain data provides invaluable insights into the cryptocurrency market, helping traders and investors make informed decisions. By analyzing key metrics such as transaction volume, active addresses, and market sentiment, traders can identify trends that may not be immediately apparent through traditional analysis.

As the crypto landscape continues to evolve, the effective use of on-chain data will become increasingly important. By integrating these insights into trading strategies, participants in the crypto market can better navigate its inherent volatility and capitalize on emerging trends.

In summary, understanding on-chain data not only enhances trading strategies but also enriches the overall comprehension of the cryptocurrency ecosystem. As technology and methodologies advance, the potential for on-chain analysis to influence market behavior will only grow, making it an essential tool for any serious trader or investor.