Unlocking the Mysteries of Algorithmic Trading Vs Copy Trading: Which Strategy Suits You Best?

Economy & Market

Algorithmic Trading and Copy Trading are two of the most commonly adopted trading strategies in today's fast-paced financial markets. Both provide investors with the advantage of carrying out lucrative transactions without the need to decipher intricate market trends or devote countless hours to market study. Despite their similar sounding nature, there exist substantial differences between these two strategies.

This article will delve into the nuances of each strategy, highlighting their respective pros and cons to aid you in identifying the option best suited to your trading goals.

Unveiling Copy Trading

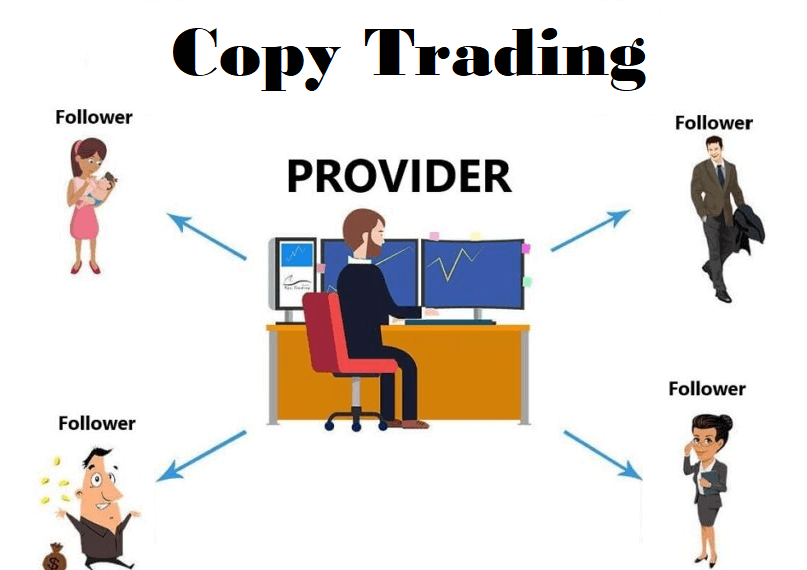

Copy Trading is an investing strategy in which traders duplicate the actions of other successful traders. Essentially, when investors copy another trader, they are replicating that trader’s position. This is a deviation from conventional investing, where individuals make their own investment decisions.

In recent years, Copy Trading has gained significant popularity as it offers a straightforward entryway for novice traders into the market without the need to make independent trading decisions. Copy Trading, however, does pose risks, as investors are often mirroring the trades of individuals who may not sustain their success in the long run. Therefore, choosing whom to follow judiciously is of the utmost importance.

Demystifying Algorithmic Trading

Algorithmic Trading is a trading methodology that employs sophisticated mathematical formulas and algorithms to make decisions. Traders leverage rule sets, indicators, and historical data to execute trades based on specific criteria such as timing, price, and volume.

Developed to manage multiple accounts or strategies simultaneously, Algorithmic Trading allows traders to execute trades faster and more efficiently than their human counterparts. It offers a range of approaches, including statistical arbitrage, high-frequency trading, and portfolio rebalancing.

The benefits of Algorithmic Trading include enhanced accuracy, speed, and efficiency, provided the automated trading strategies are designed meticulously. It also allows for backtesting of strategies to evaluate their performance under different market conditions.

The Big Question: Copy Trading or Algorithmic Trading?

Both Copy Trading and Algorithmic Trading come with their own sets of advantages and disadvantages. With Copy Trading, you are relying on another trader's judgment, which could be risky if they lack experience. In contrast, Algorithmic Trading places your trust in data-driven decisions, backed by backtesting and paper trading, making it a safer option.

Wrapping Up

In conclusion, both Copy Trading and Algorithmic Trading present unique methods for trading in the financial market. While Copy Trading allows users to automatically mimic the successful trades of experienced traders, Algorithmic Trading uses computer programs to execute trades based on predefined rules.

Choosing between the two ultimately depends on your personal preference and risk tolerance. Therefore, it is highly recommended to conduct thorough research and gather information before deciding on the trading strategy that suits your needs the best.

Ready to venture into the world of Algorithmic Trading? Register on our award-winning algo-trading platform, and get started on your algorithmic trading journey today!