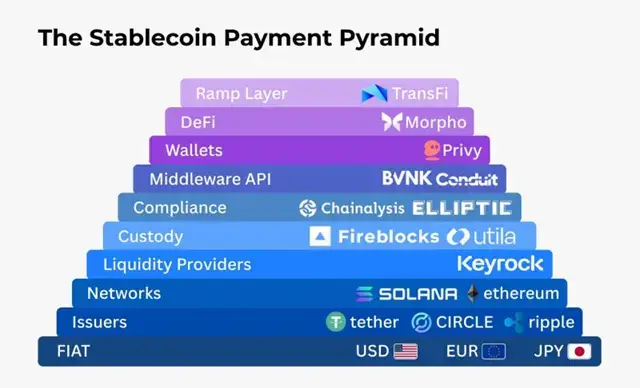

In the fast-evolving world of finance, stablecoins have emerged as a beacon of innovation. These digital currencies are designed to minimize volatility by pegging their value to traditional fiat currencies like the USD, EUR, or JPY. But behind every instant payment lies a sophisticated ecosystem, one that consists of various layers working in harmony. Let's delve into the stablecoin payment pyramid and explore how each component plays a crucial role in this transformative landscape.

Understanding the Foundation: Fiat Currency

At the base of the stablecoin pyramid is traditional sovereign money. Currencies like the US dollar and the euro serve as the cornerstone of credibility for stablecoins. They ensure that the digital assets have inherent value, making them more appealing to everyday users and businesses alike. With fiat as the foundation, we can build a robust framework for digital transactions that transcends borders.

The Role of Issuers in Stablecoin Functionality

Issuers such as Tether, Circle, and Ripple bring stablecoins to life by minting them from real reserves. The flow works seamlessly: fiat goes in, and stablecoins come out. This conversion enables funds to move globally at unprecedented speeds, creating a more efficient payment system for everyone involved. The reliability of these issuers is paramount, as users must trust that for every stablecoin in circulation, there is an equivalent amount of fiat held in reserve.

Networks: The Highway of Digital Transactions

Just as SWIFT serves banks globally, networks like Ethereum and Solana underpin stablecoin transactions. Here, money doesn’t just sit idle; it settles instantly on the blockchain. This immediate transfer capability facilitates smooth, quick payments, benefitting businesses and consumers who require fast, reliable transactions.

Liquidity Providers: The Bridge Between Markets

Liquidity providers are the architects of fluidity in the stablecoin landscape. They ensure that users can seamlessly convert stablecoins into various currencies, whether that’s transitioning USDT to USDC or any other stablecoin pair. This capability is crucial for creating a dynamic ecosystem where both cryptocurrencies and stablecoins can interact without friction.

Custody Services: Safeguarding Digital Assets

Security is a top concern in the crypto space. Companies like Fireblocks and Utila act as vaults for digital assets through multi-party computation (MPC) and rigorous governance structures. Their infrastructure safeguards user assets, ensuring peace of mind for those making the leap into digital finance.

Compliance: Ensuring Trust Through Transparency

In an industry often criticized for its lack of regulation, compliance services are vital. Firms like Chainalysis and Elliptic make sure that transactions remain traceable and compliant with existing laws. Trustworthy transactions are the backbone of a stable financial ecosystem, preventing chaos and fostering widespread adoption.

Middleware APIs: Simplifying Blockchain Complexity

As the technology behind stablecoins becomes increasingly complex, middleware platforms like BVNK and Conduit simplify the process for developers. They unify wallet orchestration, liquidity routing, and compliance integration into one user-friendly interface. This simplification is a game-changer for businesses looking to adopt stablecoin technology without delving into the intricacies of blockchain.

User-Friendly Wallets: Making Crypto Accessible

For users, wallets like Privy and Bitget provide essential functionalities such as key management and transaction tracking. Imagine a user logging into an app and immediately having access to a USDT wallet, receiving their salary without needing in-depth crypto knowledge. This ease of use lowers the barriers to entry and encourages broader participation in the digital economy.

The DeFi Evolution: Unlocking Stablecoin Potential

Decentralized finance (DeFi) platforms like RebelFi and Morpho are redefining what stablecoins can do. They allow users to earn yields, borrow funds, and provide liquidity, turning idle stablecoins into revenue-generating assets. Businesses can enhance their margins by depositing funds into DeFi protocols, illustrating how stablecoins can work effectively in tandem with innovative financial solutions.

Ramp Layers: Connecting Crypto to Real-World Economies

The final piece of the puzzle is the ramp layer. Providers like TransFi enable users to convert stablecoins into local currencies quickly. This transformation makes it possible for individuals to receive funds in their bank accounts without needing to navigate the complexities of crypto transactions. By effectively bridging the gap between the digital and physical worlds, ramp providers play a crucial role in mainstream adoption.

Conclusion: An Evolving Landscape

The stablecoin payment pyramid illustrates a compelling blueprint for the future of finance. As each layer matures, we move closer to a unified system capable of seamlessly transitioning between fiat and cryptocurrencies at a global scale. This progression promises to enhance liquidity management, improve transaction policy, and reshape how money is experienced in our increasingly digital world.