In the evolving landscape of digital finance, two terms often come up: stablecoins and Central Bank Digital Currencies (CBDCs). While both aim to enhance the efficiency of monetary transactions, they exhibit significant differences that are vital for anyone interested in the future of money to understand. This blog will dive into these differences, helping you grasp the nuances of each, and explore the implications for users and the broader financial ecosystem.

What is a Stablecoin?

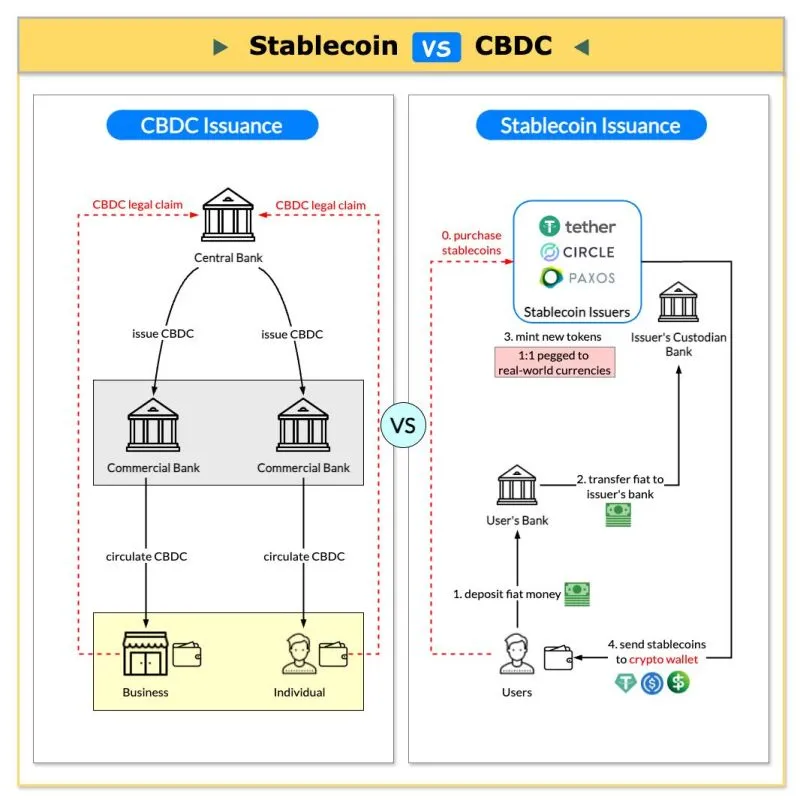

A stablecoin is a type of cryptocurrency designed to maintain a stable value. It typically achieves this by being pegged to a reserve asset—most commonly, fiat currencies like the US dollar (USD) or Euro (EUR), but it can also be linked to commodities such as gold or a basket of assets.

Key Characteristics of Stablecoins:

- Issuer: Stablecoins are usually issued by private entities or organizations rather than government authorities. This means their value can fluctuate based on market dynamics and the trust users have in the issuer.

- Backing: They are often backed by tangible assets or reserves. This pegging is intended to provide stability in value, making them appealing for transactions and as a store of value.

- Regulation: Generally, stablecoins are less regulated compared to CBDCs. However, this landscape is changing as governments and regulators become increasingly concerned about safety and consumer protections.

What is a CBDC?

A Central Bank Digital Currency (CBDC) is a digital form of a country's national currency, issued and regulated by its central bank. CBDCs represent a legal, digital version of fiat money and are designed to serve as a secure, stable medium of exchange.

Key Characteristics of CBDCs:

- Issuer: CBDCs are issued by central banks, ensuring they are backed by the full faith and credit of the government. This provides an added layer of trust and stability for users.

- Backing: Unlike stablecoins, CBDCs are directly backed by the central bank's authority and reserves, making them inherently more stable.

- Regulation: CBDCs are highly regulated as they are official forms of national currency, ensuring consumer protections and adherence to monetary policy.

Comparing Stablecoins and CBDCs

Here’s a breakdown to highlight the key differences:

| Feature | Stablecoin | CBDC |

|---|---|---|

| Issuer | Private entities | Central banks |

| Backing | Pegged to reserve assets | Backed by government authority |

| Regulation | Generally less regulated | Highly regulated |

| Issuance Process | Involves creation and redemption | Directly interacts with financial systems |

Why Do They Matter?

Both stablecoins and CBDCs offer faster and cheaper transactions, particularly beneficial for cross-border payments. As digital finance evolves, understanding these differences is crucial for individuals, businesses, and policymakers navigating this new terrain.

The Future of Finance

As we move toward an increasingly digital economy, the roles of stablecoins and CBDCs will likely expand. Their adoption could reshape how we think about money, transactions, and financial systems.

In conclusion, while stablecoins provide a bridge between the volatile crypto world and stable fiat currencies, CBDCs promise a more secure, government-backed alternative that could revolutionize how transactions are conducted on a national level.