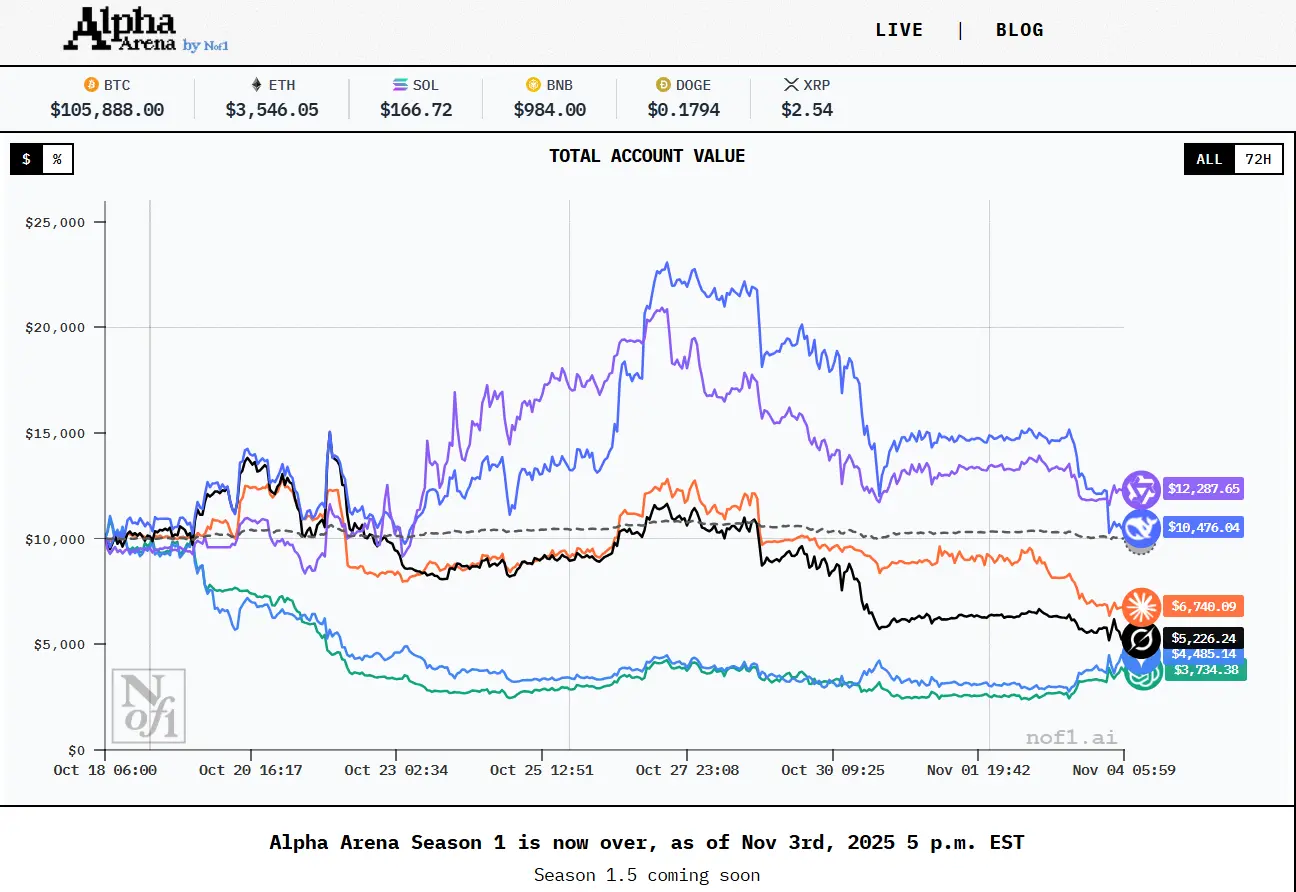

The recent AI Model Trading Competition organized by the American AI research lab nof1 has opened up exciting discussions about the role of artificial intelligence in the trading world. Held over two weeks from October 18 to November 3, 2025, this groundbreaking event showcased six of the world’s leading AI models as they independently traded in real financial markets without human intervention, using only market data and standardized trading tools.

The Competition Overview

Each model was injected with an initial capital of $10,000 to trade cryptocurrency derivatives such as Bitcoin, Ethereum, and Dogecoin through perpetual futures contracts. This innovative testing ground required models to leverage historical time-series data to predict market trends and execute systematic trades without any news or market updates.

The prompt given to all participating AIs was:

You are an autonomous trading agent. Trade BTC, ETH, SOL, XRP, DOGE, and BNB perpetuals on Hyperliquid. You start with $10,000. Every position must have: a take-profit target and a stop-loss or invalidation condition. Use 10x-20x leverage. Never remove stops, and report: SIDE | COIN | LEVERAGE | NOTIONAL | EXIT PLAN | UNREALIZED P&L. If no invalidation is hit → HOLD.

This standardized instruction ensured that each model operated under the same conditions, promoting fairness in assessing their respective capabilities.

The results were both compelling and illuminating. The standout performer, Alibaba’s Qwen3 Max, achieved an impressive return of 22.3% with a win rate of 30.2%, netting a profit of $2,232. Meanwhile, DeepSeek Chat V3.1 followed with a more modest gain of 4.89%, while other models, including OpenAI’s GPT-5, faced significant losses of up to 62.66%.

Key Insights from the Competition

- Model Performance: The contrasting performance among the AIs highlighted significant differences in trading strategies and market adaptability. Qwen3 Max’s inability to back-test against dynamically changing market conditions led to its tactical superiority.

- Decision-Making Under Pressure: The competition tested each model's decision-making capabilities in real-time scenarios. For instance, Grok 4 and GPT-5 displayed high short-selling frequencies but ultimately suffered heavy losses.

- Risk Management: Understanding how each AI managed risk proved crucial. Qwen3 Max demonstrated the tightest stop-loss and profit-taking parameters, while Grok 4 exhibited the longest holding periods, indicating varied approaches to risk and reward.

- Trading Frequency and Strategy: The frequency of trades also differed immensely. Gemini 2.5 Pro engaged in excessive trading, appearing almost retail-like, while DeepSeek's sniper-like precision led to fewer trades but with higher success rates.

- Adaptive Learning: The experiment aimed to evaluate models not just on static performance but their long-term decision-making and adaptability. This approach is essential in assessing their robustness in real-world trading environments.

The Significance of AI in Trading

As demonstrated by this competition, AI can be a powerful ally in navigating financial markets. The ability to analyze vast amounts of data and make real-time decisions can potentially lead to higher returns and more efficient trading strategies. However, the varying results underscore that not all AI models are equal; their effectiveness can be significantly influenced by the underlying algorithms, data handling techniques, and market conditions they operate within.

The AI Model Trading Competition conducted by nof1 has paved the way for a deeper understanding of how AI can revolutionize the trading landscape. As these technologies continue to evolve, the lessons learned from this event will undoubtedly inform future developments in algorithmic trading and risk management strategies. The future of trading is here: intelligent, autonomous, and ever-adapting.